Pristyn Care 🦄, Byju's 10th acquisition💸, Apple nears $3Tn🤑

Pristyn Care turns unicorn, Byju's buys Austrian firm GeoGebra, Apple nears $3 trillion m-cap, Funding Deals & more.

Hello folks👋🏻

Start your day, the smart way!

Top tech news of the day, along with a daily dose of motivation, delivered to your inbox.

1 Mail | 2 Minutes | 3 Stories | Funding Deals

Let’s get started

Pristyn Care turns unicorn after $100 million funding led by Sequoia Capital🦄

Health technology startup Pristyn Care has raised around $100 million in its Series E round, led by Sequoia Capital US, valuing it at $1.4 billion.

The Gurugram-based company has raised $85 million from Sequoia Capital, Tiger Global, Winter Capital and other existing investors, the filings showed. It is in the process of filing documents for another $15 million - which it has already raised - taking the total funding to $100 million. The three-year-old startup has seen its valuation double since April.

Founded by Harsimarbir Singh, Vaibhav Kapoor and Garima Sawhney to provide patient-centric healthcare services from disease to health, Pristyn Care has grown 5x since January this year. The company aims to expand to 1,000 surgical centres across more than 50 cities.

Healthcare and health tech companies have seen unprecedented growth due to the pandemic. In the recent past, health tech companies such as Visit, ConnectedH, HealthPlix, and mHealth have received early-stage funding from risk investors.

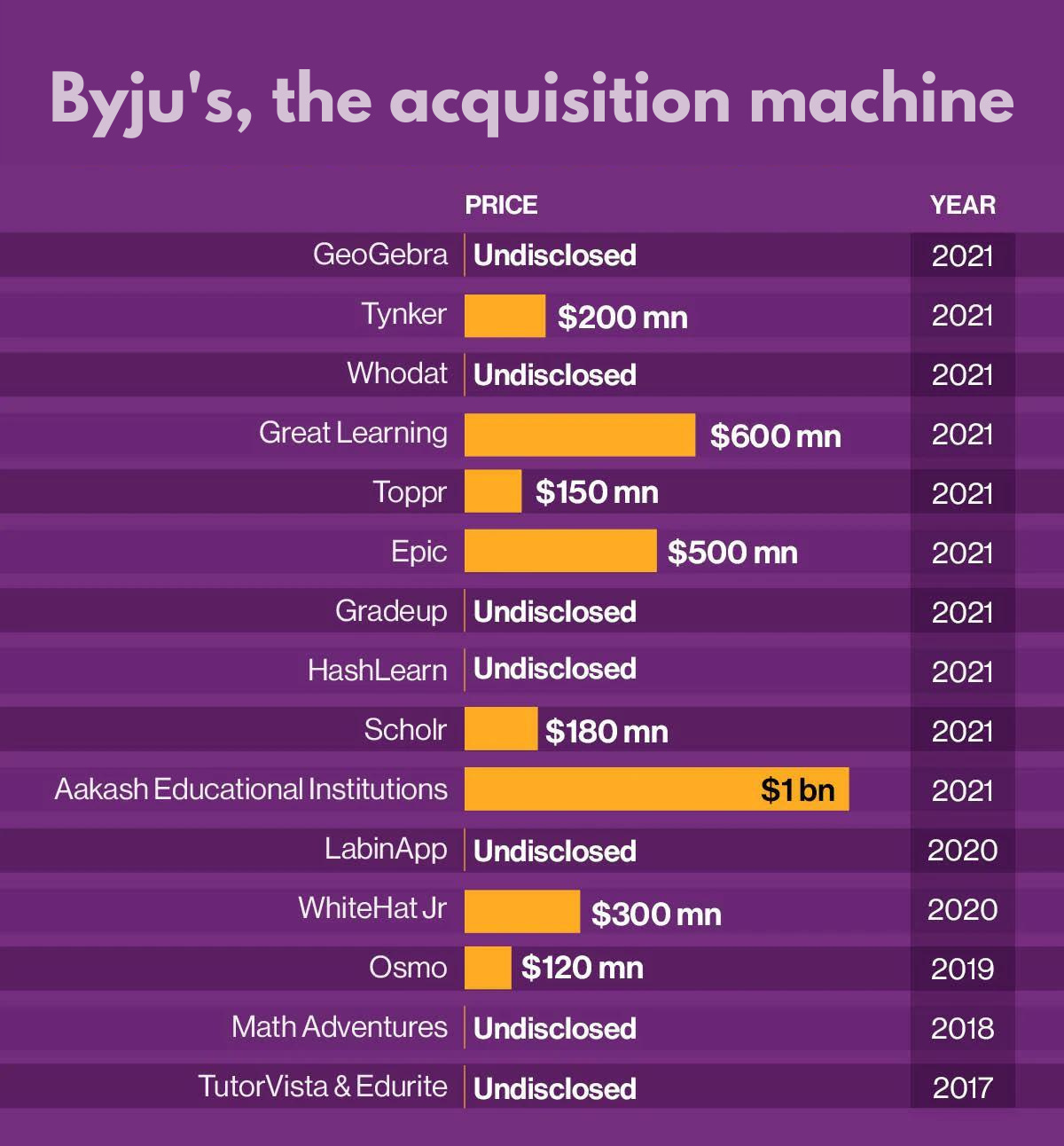

Byju's buys Austrian firm GeoGebra in 10th acquisition in 2021👏🏻

Byju's on Wednesday said it has bought Austria-headquartered math learning platform GeoGebra, making it the Indian edtech giant's tenth acquisition this year.

GeoGebra will continue to operate independently under the leadership of its founder and developer, Markus Hohenwarter, it added. GeoGebra, which was founded by Hohenwarter, Michael Borcherds and Stephen Jull in 2013, has over 100 million learners across more than 195 countries, the statement said.

Byju’s, which became a unicorn in 2018, has been ramping up its acquisition strategy this year in a bid to enter newer edtech categories of upskilling, test prep, and higher learning while fortifying its presence across key international geographies including the US.

This year alone, Byju’s has spent close to $2.5 billion in acquiring different edtech businesses.

Byju’s currently has more than 100 million registered students and 6.5 million paid subscribers. Byju’s valuation has skyrocketed since last year as the pandemic fuelled an online learning boom with parents enrolling kids in online classes.

Hot Shorts⚡

Ola Electric has raised about Rs 398.3 crore in a fresh funding round from investors such as Temasek, IIFL, Edelweiss, Vijay Shekhar Sharma and DST Global's Rahul Mehta. Bollywood personalities such as Farhan Akhtar, Ritesh Sidhwani, Zoya Akhtar and Amrita Arora have also been allotted shares in the company.

Suki.AI Inc, a health-tech start-up, has raised $55 million (around ₹412 crores) in a Series C funding round led by March Capital.

Indonesia-based fintech company Flip has raised $48 million in a Series B round co-led by Sequoia Capital India, Insight Partners, and Insignia Ventures Partners.

Exponent Energy, a startup developing fast-charging battery and charger technology for electric vehicles, has raised $5 million in funding led by YourNest VC, along with participation from 3one4 Capital and Motherson Group.

Social commerce startup Stage3 has raised Rs 20 crore in a funding round co-led by Inflection Point Ventures and LC Nueva Investment Partners LLP.

Apple nears $3 trillion in market value🥇

After a decades-long run as one of the world’s best-performing stocks, Apple Inc. is on the verge of reaching $3 trillion in market value. That’s bigger than the entire German equity market. Or the U.K. economy.

The iPhone maker needs to rise just another 6% to become the first company to achieve the milestone, less than four years after it first surpassed $1 trillion.

Apple became the world’s most valuable business thanks to a steady stream of products that have captivated consumers. Now, with markets wobbling because of concern that higher interest rates and the coronavirus will undermine economic growth, investors view the company as a relatively safe place to park their money thanks to its consistent sales growth and hefty cash balance.

Since the end of the 1990s, Apple shares have returned a whopping 22,000%, equal to about 28% a year. The S&P 500 has returned 7.5% annually in the same period.

Tweet of the day🐥

🚀Join our Telegram channel for facts, quizzes, and quotes.

Other Top Stories

⚠ Cybersecurity, digital fraud are major challenges for digital currency: RBI

💰 Alphabet, Meta paid Rs 1,254 crore as levy in FY21

“Don’t count the days, make the days count.”

-Muhammad Ali

Thanks for reading😊

We'll be back tomorrow with more interesting stories and updates.

Hit 💜, if you enjoyed the article. You can forward this mail or share it on social media.