Paras Defence made the best listing post-IPO this year🛰

Paras Defence makes stellar debut, lists at 171% premium over issue price

Hello and Welcome to

Rise n Shine☀ - Sunday Special

Every Sunday, an email will arrive in your inbox detailing a specific topic to help you understand it better.

Sign up below for free 👇🏻

Paras Defence & Space Technologies makes space cameras and it just made the best listing post-IPO this year

The initial public offering (IPO) from the Navi Mumbai-based defence equipment maker was hot right from the word go. The listing for Paras Defence & Space Technologies was even better.

Those who got shares in the IPO nearly tripled their money within a few minutes of the listing before the exchanges put a stop on the trading because the share price had surged more than what the bourses allow on the opening day.

List of companies in 2021 that made a blockbuster debut on stock exchanges with at least 100% gains on listing day

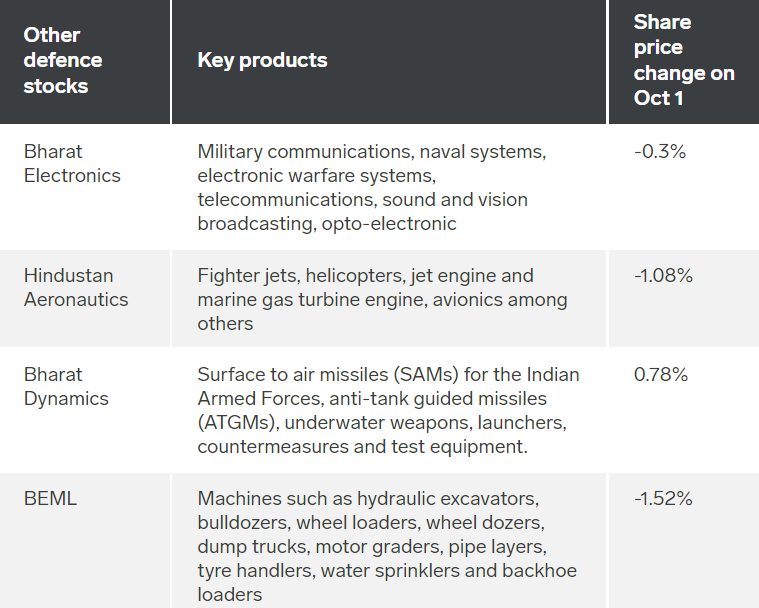

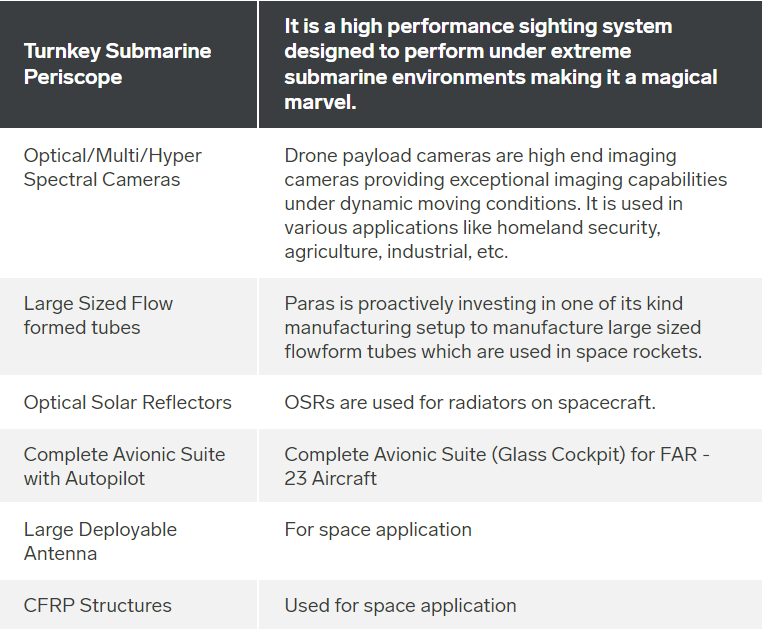

There are other defence equipment makers in the country, but none of those listed have the kind of product portfolio Paras has. It makes stuff for defence and space optics — such as space cameras, infrared devices, diffraction gratings which help in improving image resolutions — defence electronics, electro-magnetic pulse (EMP) protection solution and heavy engineering.

So much so that Paras supplies inputs even to some of its listed peers.

Two-thirds of its current order book, worth ₹300 crores, is for these cameras and related products.

The company has been a part of most of the earth observation and space exploration missions since 2018, said ICICI Direct report citing a Frost and Sullivan Report.

The Indian government is increasingly pushing the Ministry of Defence to buy ‘Made in India’ products as well as pushing Indian defence equipment makers to export.

According to Motilal Oswal, the government outlay to buy products where Paras Defence is a player is expected to rise more than four times, from $3.2 billion allocated in the year ending March 2021 to over $14.5 billion, in the next decade.

Half of the company’s ₹1,433 crore revenue at the end of March 2021 came from government projects. Another one third came from the private sector. The rest was from exports.

The company has raised ₹170 crores from the IPO and wants to invest the money in new equipment.

Some of Paras Defence’s products under development include:

However, if one had to evaluate the company on some of the traditional metrics like return on equity or return on capital employed, it may not seem as attractive. Since Paras Defence’s performance involves a lot of innovation and development, its working capital cycle is long, over 300 d

ays, according to analysts. And the existing cash flow doesn’t cover it.

Most of its contracts have a fixed price and so, the company runs the risk of cost overruns if it isn’t efficient. The company’s profit margin was a little over 12% in the financial year 2019 and has fallen since then, due to the effect of the pandemic, to a little over 11%.

See also: Paras Defence becomes most oversubscribed IPO🛰

Hit 💜, if you enjoyed the article.

Don't forget to share it with your friends.🤗