Tata Neu is live now 🤩, Flipkart eyes IPO 💰, Rebel Foods acquires Smoor 🍫

Tata's all-in-one superapp ‘Tata Neu’, Flipkart eyes IPO valuation of $70 Bn, Rebel Foods acquires majority stake in luxury chocolate brand, Funding Deals & more.

Morning folks🙋🏻♂️,

Start your day, the smart way!

Top tech news of the day, along with a daily dose of motivation, is delivered to your inbox.

1 Mail | 2 Minutes | 3 Stories | Funding Deals

Let’s get started

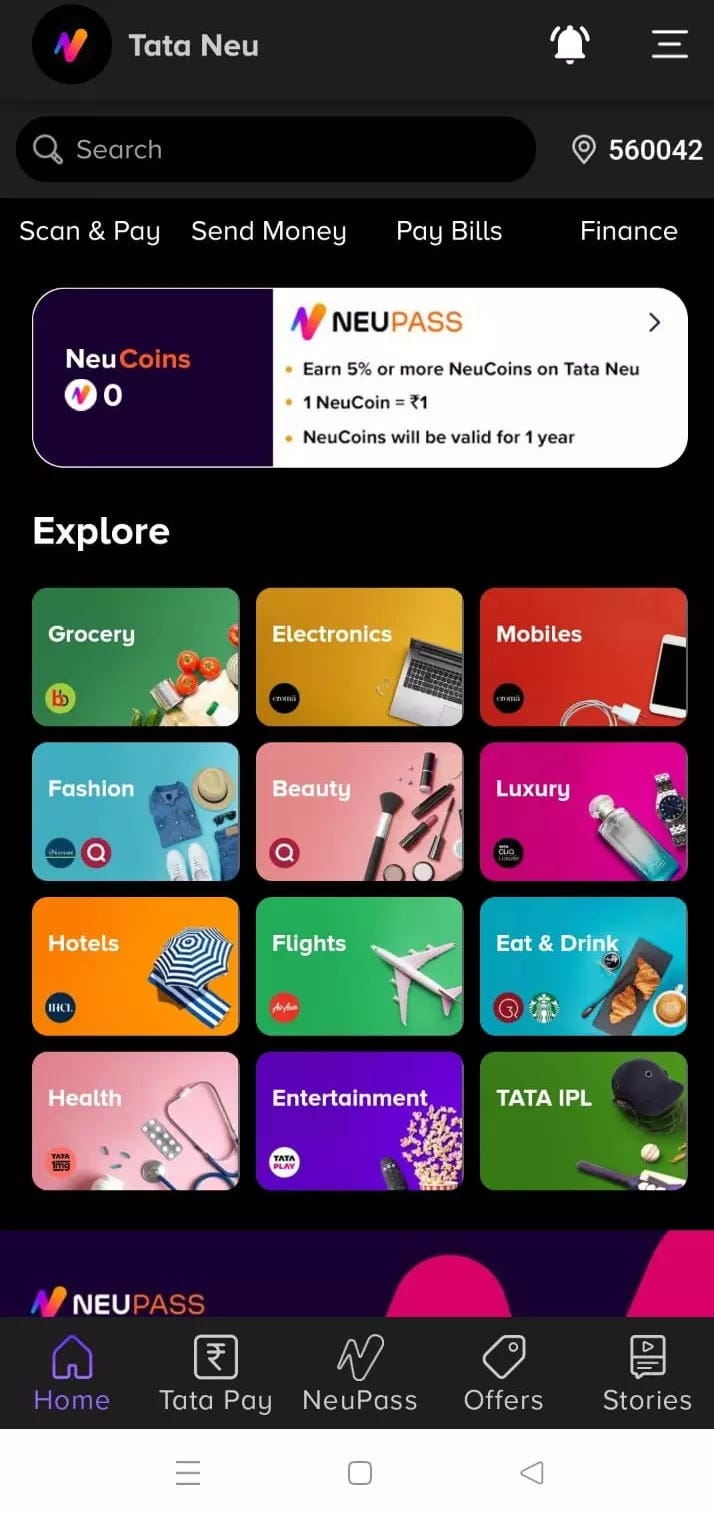

Tata's all-in-one super-app ‘Tata Neu’ is live for all users🤩

After several delays, Tata Group finally launched its much-awaited super app Tata Neu for the public on Thursday.

“Tata Neu is an exciting platform that gathers all our brands into one powerful app,” Tata Sons chairman N Chandrasekaran said in a LinkedIn post, “Combining our traditional consumer-first approach with the modern ethos of technology, it is an all-new way to discover the wonderful world of Tata.”

Tata-owned brands including BigBasket, 1mg, Croma, AirAsia, IHCL, Qmin, Starbucks, Tata Cliq, Tata Play, and Westside will be available on the super app initially, he said. Vistara, Air India, Titan, Tanishq, and Tata Motors will be added soon, Chandrasekaran said.

Described as a “super-app" and in the pipeline since at least mid-2020, the website called it “a unified platform that connects several brands across the Tata universe like never before."

Flipkart eyes IPO valuation of $70 bn, US listing next year📊

Walmart's Indian e-commerce company Flipkart has internally raised its IPO valuation target by around a third to $60-70 billion, and now plans a U.S. listing in 2023 instead of this year.

Flipkart, which competes with Amazon.com Inc in India's booming e-commerce space, had earlier set an IPO valuation goal of $50 billion, Reuters has reported. The listing, according to sources, is now being planned for early-to-mid 2023. Flipkart is incorporated in Singapore and wants to list in the United States.

The main reason for waiting for the IPO is due to Flipkart's internal plan to boost valuations further by focussing on two of its relatively new businesses -- online healthcare services and travel booking.

Flipkart acquired Indian travel booking website Cleartrip in 2021, and this week launched a "Health+" app to offer medicines as well as other healthcare products and services.

Hot Shorts⚡

Taki, a global token-powered social network, has raised $3.45 million from 11 global investors including CoinDCX, Coinbase Ventures and others.

Social commerce platform Rozana has raised $2.5 million in a pre-Series A funding round co-led by 3one4 Capital and Europe’s IEG-Investment Banking Group.

D2C food brand WickedGud has secured $1 million in a seed round led by Mumbai Angels and other marquee investors.

Beverage company Jimmy’s Cocktails, which sells non-alcoholic spirits mixers, has raised ₹14 crores in a bridge round ahead of its Series A, led by Roots Ventures and 7Square Ventures.

Rebel Foods acquires majority stake in luxury chocolate brand Smoor🍫

Rebel Foods, which operates a network of cloud kitchens and digital brands, has acquired a majority stake in luxury chocolate brand Smoor, in its run-up to becoming a brand aggregator in the food and beverage (F&B) space.

The announcement comes within months of Rebel Foods announcing that it is looking to invest $150 million over the coming years, as part of its focus on investing and acquiring promising close to 40 brands to serve more food categories from its cloud kitchens.

The Mumbai-based company has created brands such as Faasos, Behrouz Biryani, Ovenstory Pizza and Mandarin Oak. Last year, it took over the India franchise of US burger brand Wendy’s.

Rebel Foods had said in October that it planned to launch its IPO in the next 18-24 months. It operates more than 450 kitchens in 10 countries, including Indonesia, the United Arab Emirates and the United Kingdom.

Tweet of the day🐥

🚀 Join our Telegram channel for daily market highlights.

Other Top Stories

👑 We will make long-term investments in India: Coinbase CEO Brian Armstrong

🎓 Talentedge's owner takes stake in upGrad at $2 billion value after integration

"Risks must be taken because the greatest hazard in life is to risk nothing."

- Leo F. Buscaglia

Thanks for reading😊

We'll be back with more interesting stories and updates tomorrow.

Don’t forget to check our Instagram, Twitter, Youtube, and LinkedIn.

Share with your friends, if you enjoyed the article.🤗